By Tim Pitt

1 year ago

By Tim Pitt

1 year ago

Should you finance a Porsche purchase in 2024?

Car finance expert Gerard Liddon offers advice on how best to pay for your Porsche

Many of us can’t afford to buy a Porsche outright, so finance is the obvious option. But how can you be sure of getting credit, finding the lowest rates and achieving the best price for your trade-in? We spoke to Gerard Liddon, an independent broker with nearly 30 years of experience, for his expert advice.

Gerard has helped his clients to buy everything from a 911 Carrera to a Carrera GT, and is among the few brokers to deal with Porsche racing cars. The company he works for, Rare Car Finance, is also owned by 9WERKS-approved dealer Jonathan Franklin Cars, whose stock list at the time of writing includes a 959 and 997 Speedster.

“The market has been through some turbulent times,” says Gerard. “The so-called ‘technical recession’ towards the end of 2023 certainly felt like the real thing and there’s been a massive disparity in interest rates on finance. Land Rover, for example, was offering between 6.9% and 12.9% – but the lowest rate was effectively subsidised to shift unsold cars.”

Porsche rarely has that problem, of course, but depreciation on some models, along with the wider economic situation, has pushed up the cost of borrowing. Thankfully, the outlook seems to be getting brighter for anyone planning to buy their dream car. Read on for Gerard’s top five tips for financing a Porsche in 2024.

1. Be prepared

As anyone who ever joined the Scouts can confirm, being prepared will help you pre-empt any problems. “If you’re coming towards the end of your finance term, you need to be planning six or eight weeks in advance,” advises Gerard.

Signing up to a company such as Experian or Equifax will allow you to see your credit score and identify any issues. “Even a minor unpaid bill, such as a library book loan, could lead to you being refused finance. The lender – Porsche Financial Services, for example – won’t necessarily give a reason for the refusal. They will simply advise you to check your credit history.” Being aware of any problems could help you avoid headaches later.

2. Think about depreciation

Depreciation is often the biggest cost when it comes to running a car. If you buy on finance, this loss in value over time is taken into account in the monthly payments – and the final ‘balloon’ payment if you have a PCP deal and decide to keep the car, rather than hand it back.

If you choose the latter option, PCP agreements have a guaranteed buyback figure, which means the only additional charges could be for excess mileage or any damage. However, with other types of finance, the car’s value isn’t set in stone. “A lot of Porsches have taken a big hit,” adds Gerard. “The 992 Turbo S is a good example. People thought they could flip them for profit, but that hasn’t been the case. The electric car market is also fractious, to say the least. Some people have taken the plunge with a Taycan, then discovered they simply can’t live with an EV.”

Categories

3. Shop around

Find out what your car is worth before trading it in, or you could be left out of pocket. “Don’t just accept the supplying dealer’s valuation,” says Gerard. “Ring around three different Porsche centres or specialists for a quote.” You could even play one dealer off against another for a higher bid.

When it comes to arranging a new finance deal, it’s worth bearing in mind that franchised dealers will always offer better rates on new cars than used ones. But an independent broker such as Rare Car Finance can provide the same rate across all vehicles. Gerard cautions: “I’m told a lot of Porsche dealers try to reject third-party finance. They’ll say ‘We can’t accept that bank’, or something along those lines. This is against Financial Conduct Authority [FCA] protocols, but a customer could be caught out if they’re a bit naive to the regulations.”

4. Check what you can afford

The latest figures from the Association of British Insurers (ABI) show the average cost of car insurance has increased by 34% in the past year alone. Against this backdrop of rising bills, it’s vital to work out how much you can afford to pay each month. We’d all love a new Porsche, but keeping a roof over your head and the creditors from your door is clearly more pressing.

Again, Gerard suggests setting aside time to plan six or eight weeks before your current finance term is due to expire. “Many people will leave things until the last minute, then realise the sums don’t quite add up.”

5. Be positive for 2024

After the lull in late 2023, and despite uncertainty of a General Election on the horizon, Gerard now says things are looking up. “This year seems much more positive. “I think there will be back-room conversations between the government and the Bank of England to lower interest rates as 2024 goes on. However these will come down gradually, and won’t ever go back to where they were. Rates were simply too low for too long.”

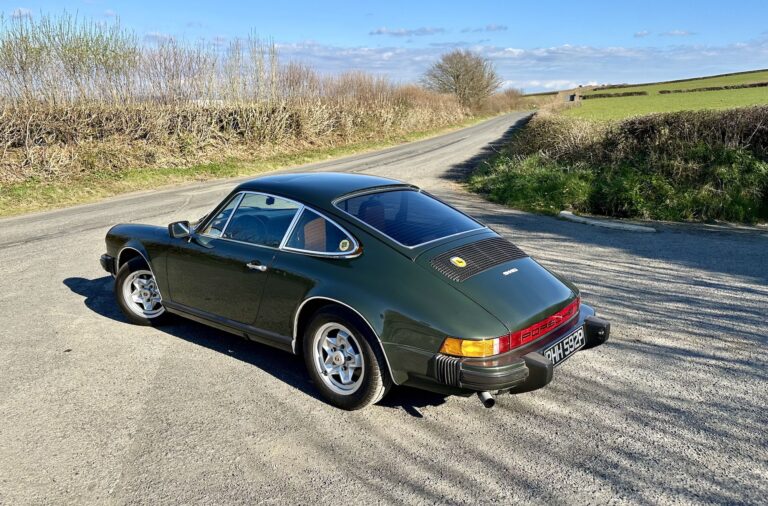

If that means your perfect Porsche is now within reach, so much the better. But remember, there are fantastic cars in the 9WERKS Marketplace to cater for a broad range of budgets, from a £19,995 996 Carrera at Philip Raby Specialist Cars to a £999,995 993 GT2 R at Paragon Porsche. Good luck, be prepared and make sure your car is driven, not hidden.

Want to talk further with Gerard or Jonathan? Visit the Rare Car Finance website for more information.